- Racket Business

- Posts

- College Tennis - Providing the Workforce for the Tennis Industry

College Tennis - Providing the Workforce for the Tennis Industry

Gary Horvath on the discussion that's a wake-up call to RSPA and PTR

College Sports - Five Years of Chaos

For the past five years, the business of college sports has been “chaotic.”

Challenges included COVID-19 policies, higher inflation, and rising operating costs.

On July 1, 2021, the NCAA implemented a policy allowing college athletes to receive compensation for their personal brand, or the use of their name, image, or likeness (NIL) for endorsements, social media marketing, merchandise promotions, or public appearances that benefit a specific organization.

College athletes could be paid directly with the House settlement. Roster limits replaced scholarship limits. Third-party groups monitored NIL agreements to ensure fair market values.

The chaos put the fear of God in coaches and athletes in minor sports programs who were worried that funding for their programs would be reduced or eliminated. Many tennis programs were concerned.

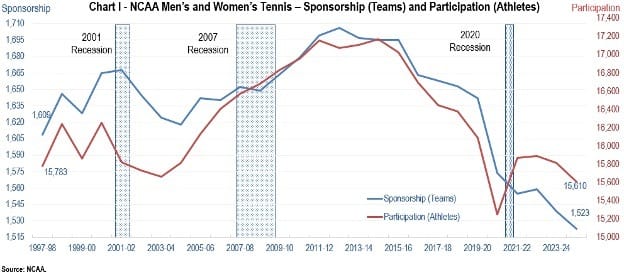

Total Sponsorship (Number of Teams) and Participation (Number of Athletes).

For the 2024-25 season, there were 1,523 men’s and women’s programs, sixteen fewer than the previous year and fifty-one fewer than in the 2020-21 season (Chart I). The number of athletes decreased by 207 between 2024-25 and 2023-24 but increased by 358 between 2024-25 and 2020-21.

The 2024-25 totals are below 1997-98 totals, and the peak for participation (2014-15) and the high point for the number of programs (2012-13).

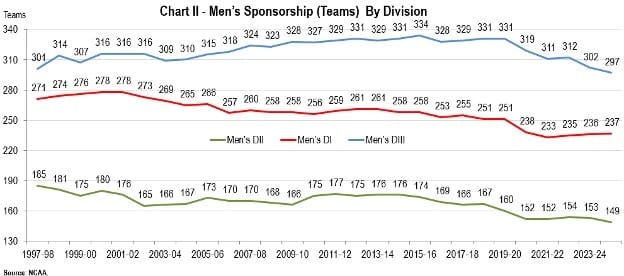

Men’s Sponsorship

This past season, there were 683 men’s programs, eight fewer than the prior year and twenty-six fewer than in 2020-21 (Chart II). During the 2024-25 season, 34.7% of the programs were DI teams, 21.8% were DII teams, and 43.5% were DIII teams.

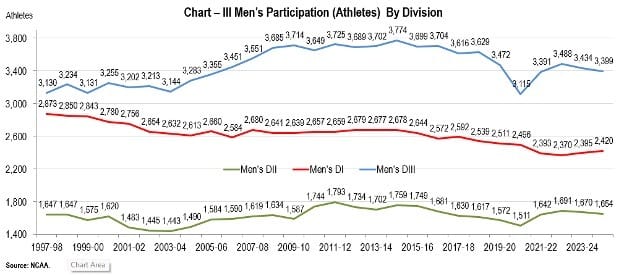

Men’s Participation

During the 2024-25 season, there were 7,473 male athletes, twenty-six fewer than the previous year and 351 more than in the 2020-21 season (Chart III). The number of participants per team increased from 10.0 to 10.9 athletes.

The mix of players by division was similar to the mix of teams by division. About 31.6% of the players were in DI programs, 21.6% in DII programs, and 44.4% in DIII programs.

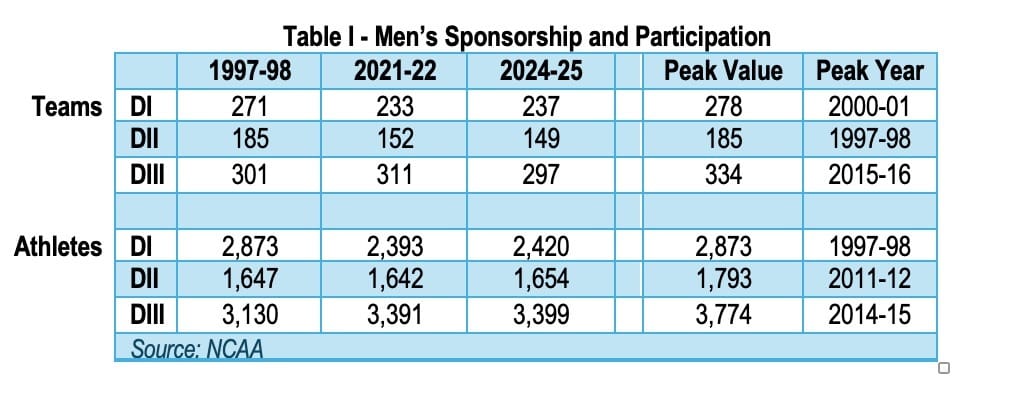

The data in Table I summarizes the trends of Charts II and III.

Men’s DI – The number of teams has trended downward since the 2000-01 season. The number of athletes has trended lower since 1997-98.

Men’s DII – The number of teams has trended lower since 1997-98. The number of players has trended down since 2011-12.

Men's DIII – The number of teams trended upward from the 1997-98 season through the 2015-16 season. It has since trended downward. Participation peaked in 2014-15 and has since trended downward.

To date, the “chaos” that has occurred since 2020-21 has had a slight negative impact on the number of teams and a minuscule effect on participation.

Women’s Sponsorship

During the 2024-25 season, there were 840 women’s teams, eight fewer than the previous season and twenty-five fewer than in 2020-21.

About 36.2% of the programs were DI teams, 24.4% were DII teams, and 39.4% were DIII teams.

The women’s teams accounted for 55.2% of the total men’s and women’s teams.

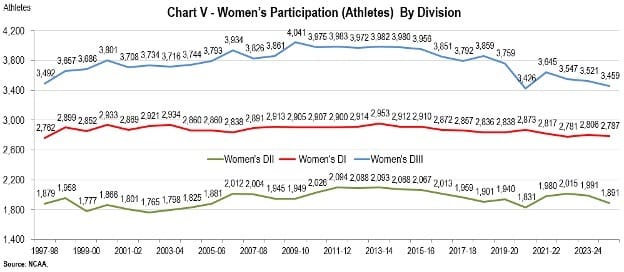

Women’s Participation

During 2024-25, there were 8,137 female athletes, 181 fewer than the previous year. There were 9.7 women athletes per team.

In 2024-25, there were seven more athletes than during the 2020-21 season. About 34.3% of the players were in DI programs, 23.2% in DII programs, and 42.5% in DIII programs.

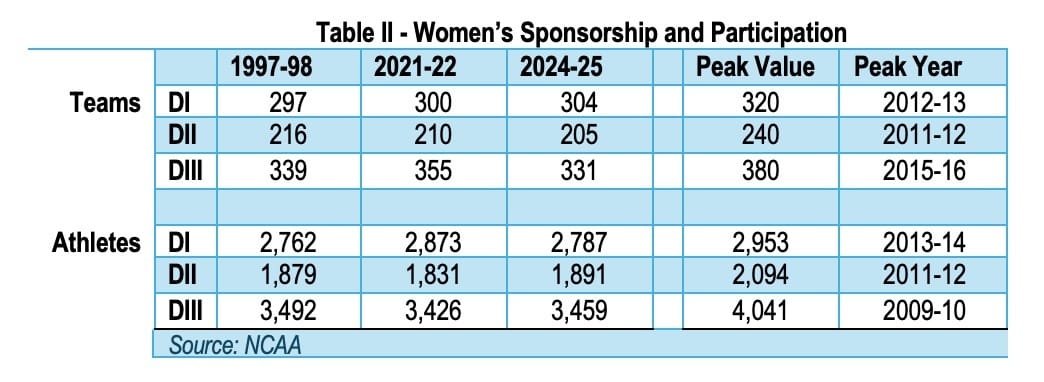

The data in Table II summarizes the trends of Charts IV and V.

Women’s DI – The number of teams and participants was stable between 1999-20 and 2019-20. The number of athletes was consistent during that period.

Women’s DII – The number of teams peaked between 1999-20 and 2019-20. Between 2006-07 and 2016-17, the programs typically had more than 2,000 participants.

· Women’s DIII – Usually, there were more than 360 teams between the 2000-01 and the 2019-2020 season. Participation was usually greater than 3,700 between the 2000-01 and 2019-2020 seasons. It has since trended downward. Participation peaked in 2014-25 and has since trended downward.

· To date, the “chaos” that occurred since 2020-21 has reduced the number of teams and had a minuscule positive impact on participation.

College Tennis Matters

College tennis programs matter to the athletes and coaches. They matter to the local and regional communities, who often have access to college facilities, athletes, and coaches. Most importantly, college tennis programs matter to the tennis industry. They are the primary source of the workforce for career teaching professionals in all market segments - parks, schools, recreation facilities, and clubs!

Chart I showed that college tennis is declining. The amount of decline depends on the period and whether you are talking about participation or sponsorship. For example, total sponsorship declined from 1,706 teams in 2012-13 to 1,523 teams in 2024-25. Total participation dropped from 17,171 in 2014-15 to 15,250 in 2020-2021. Women’s programs have typically fared better than men’s programs.

At the same time, the USTA reported that U.S. tennis participation increased significantly.

Each year, 1,500 to 1,800 men's tennis athletes and 1,600 to 1,900 women's tennis athletes graduate from college. They will become doctors, lawyers, biologists, chemists, sales staff, managers, technicians, and more. A small portion of them will pursue tennis careers.

Population Matters

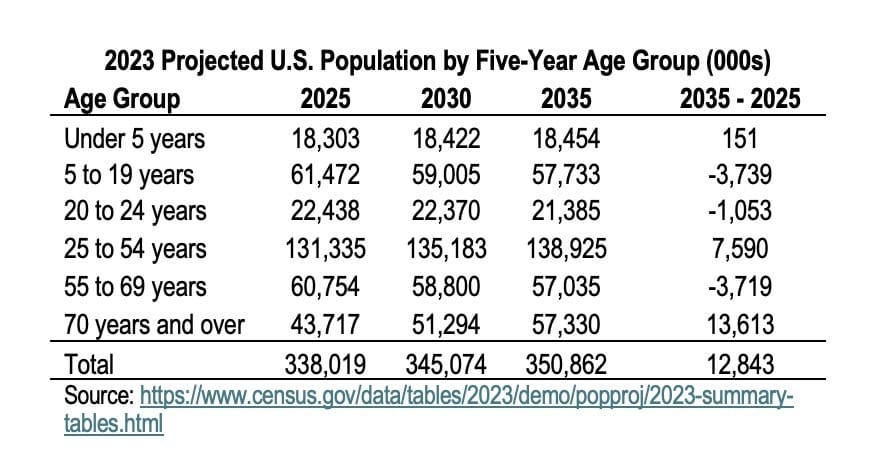

Table III includes U.S. population projections for 2025, 2030, and 2035. The population is expected to increase by 12.8 million people between 2025 and 2035. The most significant increase is in the 70+ year age category. That is not a prime market for tennis players or for recruiting people to pursue careers in the industry. The other area of growth is the 25-to-54 age group. Currently, this category has about 131 million people, and it is likely to increase by 7.6 million over the next decade. The 25-to-54 age group is the primary market for recruiting tennis players and professionals.

Significant population declines are likely for the 5-to-19, 20-to-24, and 55-to-69 age groups. These are secondary markets for the tennis industry.

The mix of the population will significantly affect tennis participation and the demand for tennis professionals.

Wake-Up Call

The discussion about college tennis (suppliers for tennis professionals) and the population (suppliers for tennis athletes) should be a wake-up call to the RSPA and PTR!

Over time, college athletic programs have improved the learning experience for tennis athletes on the court and in the classroom. As a result, numerous tennis athletes are better prepared to enter the tennis workforce than their predecessors, especially if they have received mentoring. The RSPA and PTR can work with college tennis to ensure they continue to provide exceptional learning experiences for its men’s and women’s tennis programs.

Many facility owners have raised their expectations for certified professionals. Obviously, they expect strong leadership and management skills. Tennis professionals may also be expected to have expertise in multiple racquet sports. Again, the RSPA and PTR must work with facility owners to better understand their workforce needs.

The next decade will provide a terrific opportunity for the RSPA and PTR to raise the bar for certification and education programs. Their efforts to strengthen industry leadership and teaching expertise will make tennis more relevant in the years ahead.

Gary Horvath | Gary Horvath is a USPTA master pro, founder, and past president of the USA Professional Platform Tennis Association, a charter member of PPTR, a certified coach with USA Volleyball, and a long-standing member of the Wilson Advisory Staff. His experience as a tennis pro has covered the entire spectrum from grassroots to college tennis. |

In addition, Gary Horvath has conducted extensive business and economic research that has largely supported the state of Colorado's economic development efforts.