- Racket Business

- Posts

- The Upcoming Dogfight to Attract and Retain Tennis Athletes

The Upcoming Dogfight to Attract and Retain Tennis Athletes

Gary Horvath: Teaching professionals must bring a higher level of creativity to the process of attracting and retaining players

The Upcoming Dogfight to Attract and Retain Tennis Athletes

Over the next decade, the tennis industry will be in a fierce dogfight to attract and retain tennis players. It must bring its “A” game to come out on top.

The data in Chart I tells two stories:

The U.S. population is forecasted to increase from 334,906,305 in 2023 to 350,861,084 in 2035.

The blue line is not as rosy. It will be the source of the dogfight. The U.S. population increases at a decelerating rate, from 1,618,748 in 2023 to 1,053,437.

The following discussion segments the population into the youth market, the primary market, and the senior market and analyzes changes in all three areas. Punchline Alert: The population change is distinct for each market segment.

Population Under 25 Years - Youth Market

The dogfight for the population under 25 years will be severe.

In Chart II, there is a decline in population levels between now and 2035 for the three age groups: 0 to 5 years, 6 to 17 years, and 18 to 24 years. The primary reason is lower fertility rates. The lower population levels have been an ongoing challenge as schools, sports programs, and colleges have reduced programs and services.

More specifically, tennis programs at K-8 schools, recreation centers, high school programs, club programs, college teams, and post-college or early adult sports activities will face stiffer competition from a more diverse set of competitors for a smaller pool of potential athletes.

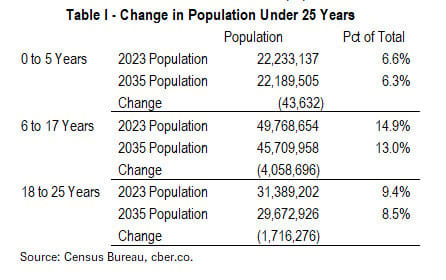

Table I shows the actual absolute and relative decreases in population for the three age groups.

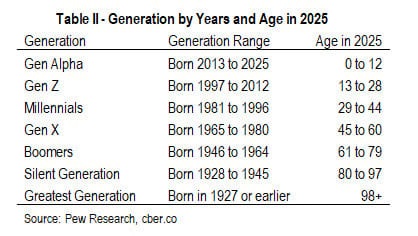

Table II provides the generation birth dates and years of age that may be useful when analyzing the four population charts.

Population Ages 25 to 64 Years - Primary Market

The primary age range for tennis athletes is either 25 to 54 years or 25 to 64 years. These are also the primary years for the tennis workforce.

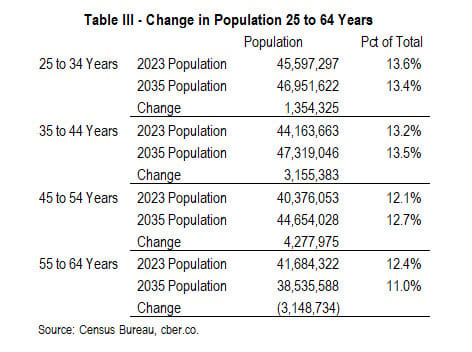

There are four population age groups in Chart III: 25 to 34 years, 35 to 44 years, 45 to 54 years, and 55 to 64 years.

The population in the first three age groups posted gains. Only the 55 to 64 age group posted a decline.

There will be a dogfight for athletes in this age group. It is the primary target market for many other activities and facets of life.

Table III shows the actual absolute and relative population changes for these four age groups.

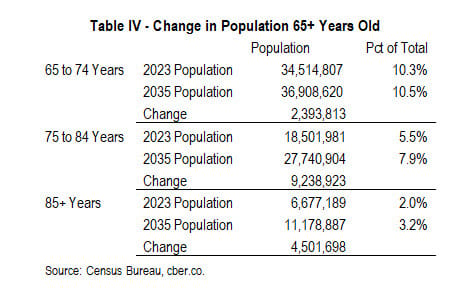

Table IV shows the actual absolute and relative changes in population for the three age groups.

Population All Age Categories

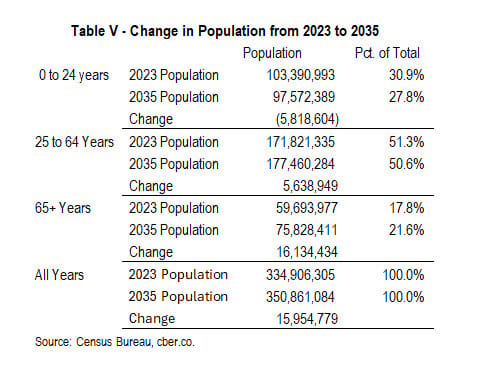

The United States population is forecasted to increase by about 16.0 million (4.8%) between 2023 and 2035.

During that period, the population of the 65+ years group is forecasted to increase by slightly more than 16 million (+27.0%). The increase of 5.6 million (+3.3%) in the 25 to 64 years group will be offset by 5.8 million (-5.6%) fewer people in the 0 to 24 years group.

For the tennis industry to remain vibrant, teaching professionals must bring a higher level of creativity to the process of attracting and retaining players as they address the following three challenges:

Greater competition in the "primary market" for tennis and many other activities.

Increased competition in the declining "youth" market.

Convincing the “senior” players that tennis is a sport they can play for a lifetime.

It is going to be a dogfight!

Gary Horvath | Gary Horvath is a USPTA master pro, founder, and past president of the USA Professional Platform Tennis Association, a charter member of PPTR, a certified coach with USA Volleyball, and a long-standing member of the Wilson Advisory Staff. His experience as a tennis pro has covered the entire spectrum from grassroots to college tennis. |

In addition, Gary Horvath has conducted extensive business and economic research that has largely supported the state of Colorado's economic development efforts.