- Racket Business

- Posts

- Nike and On Make Their Racket Sport Side Bets

Nike and On Make Their Racket Sport Side Bets

With landmark signings in pickleball and padel, both brands signal that the fastest-growing racket sports have become too big—and too visible—to ignore.

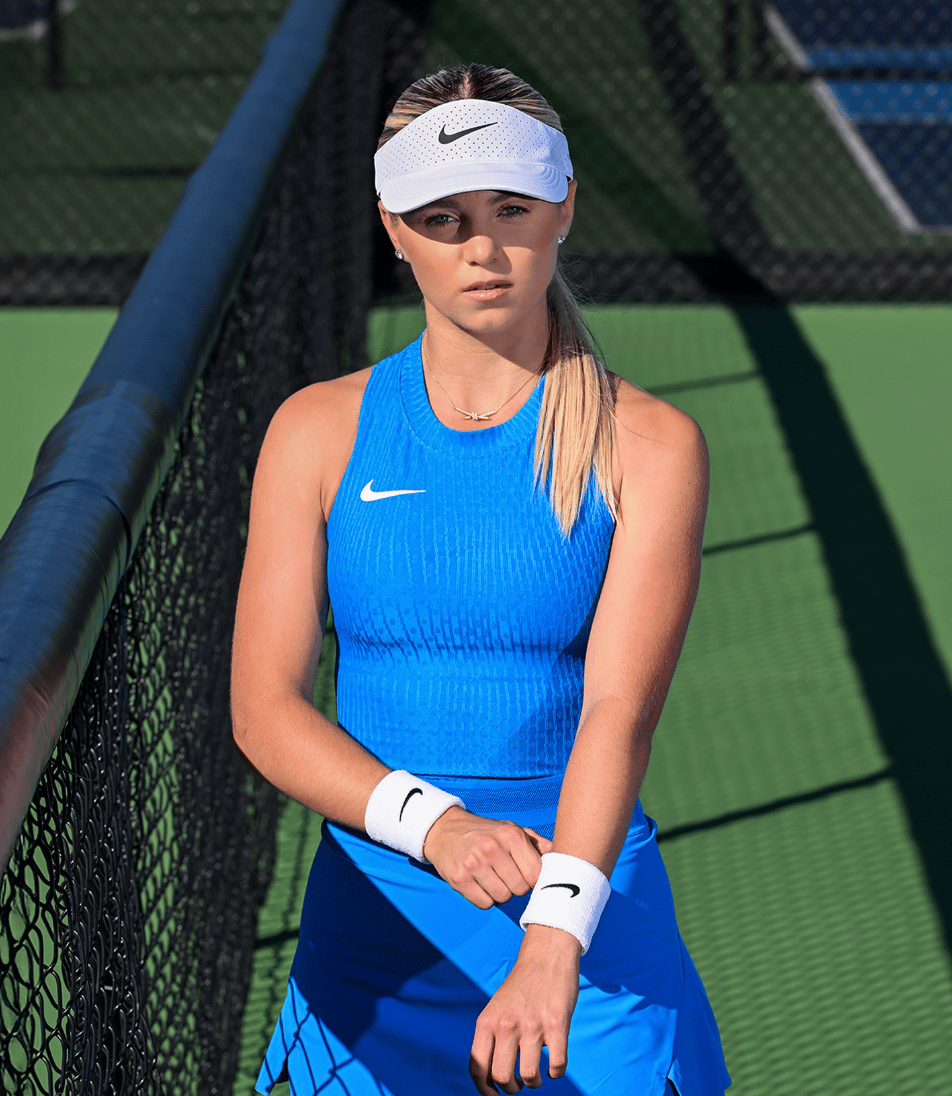

Yesterday, world No.1 pickleball player Anna Leigh Waters announced a landmark partnership with Nike, making Swoosh history as the brand’s first-ever sponsored pickleball athlete. At just 18 years old, Waters becomes Nike’s official entry point into the professional pickleball ecosystem.

The move comes just weeks after Swiss sportswear brand On made its own crossover play, entering padel by signing world No.1 Arturo Coello to a head-to-toe endorsement deal. The partnership will deliver On’s first padel-specific performance footwear—another notable first for a major, non-specialist brand.

What makes both signings particularly interesting is their timing. Nike and On have spent the past few years doubling down on tennis. Nike, after deprioritising the category in favour of higher-impact sports, has recently refocused its investment around a tight group of elite stars—Sinner, Alcaraz, Osaka and Sabalenka—while trimming its wider roster. On, meanwhile, has been steadily disrupting tennis since Roger Federer joined as an investor and ambassador in 2019, building out footwear, apparel and a credible athlete lineup including Iga Swiatek, Ben Shelton and a cohort of next-gen prospects. More recently, it has layered in cultural cachet via high-profile ambassadors like Burna Boy as part of a broader tennis-fashion push.

Given how central tennis has become to both brands’ strategies heading into 2026, it was surprising to see them step outside the sport—almost simultaneously—to sign professional ambassadors from adjacent racket disciplines.

Despite explosive growth at the amateur level, pickleball and padel have largely been ignored by the biggest sportswear players. Until recently, Adidas was the only major brand meaningfully involved in padel, while others—including Nike and On—appeared content to cede the space and focus on more lucrative categories like running, or more commercially proven sports like tennis.

Part of the hesitation has been structural. From a product perspective, most consumers can comfortably wear tennis footwear and apparel for padel or pickleball. The sports haven’t been sufficiently differentiated to justify bespoke performance lines, making athlete signings harder to rationalise without clear product stories to support them.

There’s also a brand perception challenge. While both sports are undeniably fun and participation continues to surge, neither carries the same cultural heat, broadcast intensity or superstar power as tennis, basketball or football. For brands that trade in big moments and mass-market aspiration, that makes investment harder to justify—particularly when near-term revenue upside is limited. It’s the same logic that’s seen Nike scale back its presence in sports like golf and cricket.

And yet, despite all of that, Nike and On have each signed the world No.1 athlete in pickleball and padel respectively—within weeks of one another.

In On’s case, the ambition is clear. The brand will work with Coello to develop padel-specific products, starting with footwear, positioning itself as the first major player to become the go-to brand for padel’s modern era. Nike’s approach is more conservative. For now, Waters will compete in and promote products from the existing Nike Court and Nike Tennis ranges, rather than driving immediate pickleball-specific innovation.

From a business standpoint, both moves make sense. On’s investment—particularly in footwear R&D—will be significantly heavier than Nike’s. But neither brand is betting that padel or pickleball will materially move the needle on revenue in the short term. Instead, the upside is marketing-led. Participation, awareness and cultural relevance across both sports have reached a point where continued absence is no longer defensible, especially as adoption accelerates across North America, Europe and key growth markets like the Middle East.

Nike is unlikely to suddenly flood the market with pickleball-specific product. But signing Waters so early in her career gives the brand instant credibility and long-term optionality. If and when the professional side of pickleball breaks into the mainstream, Nike will already be embedded at the top of the sport—exactly where it prefers to be.